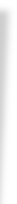

PAUL A. NEWTON

© 2015 : Privacy Policy

Call : 910-769-2896

PAUL A.

NEWTON

ATTORNEY AT LAW

Post Office Box 1807

Wilmington, N.C. 28402

910 769 2896

Areas of Practice

Probate and Estate Administration

We can assist Homeowners in protecting their most valuable assets, including their home.

Mr. Newton has always provided advise concerning and preparation of Wills and Trusts.

North Carolina probate law dictates how a decedent's estate, assets and properties are transferred and distributed to family member and loved ones.

We appreciate the difficulty of dealing with the loss of a love one. Our goal in every estate administration is to guide the personal representative through the process in the most efficient, economical manner available. Although it may seem straightforward, navigating an estate administration through the court system requires skill and expertise. Let our dedicated team of professionals help guide you through the process.

Paul A. Newton is currently working as a solo practitioner under the firm heading of Paul A. Newton, Attorney at Law. Mr. Newton was admitted to the North Carolina State Bar in 1987. He graduated in 1978 from MIU-Fairfield in Iowa, where he earned a Bachelor of Arts degree in Business Administration. He obtained his Juris Doctor degree, with honors, from Campbell University in 1987, where he served as a member of the Campbell Law Review and as coordinator for the 1986 National Moot Court Team. Mr. Newton is a member of the North Carolina State Bar and New Hanover County Bar Association, and is a licensed North Carolina Real Estate Broker.

Post Office Box 1807 Wilmington, N.C. 28402

Bankruptcy and Foreclosure Defense

107 North 2nd Street Wilmington, NC 28401

Probate and Estate Administration

Wills, Trusts, and Powers of Attorney